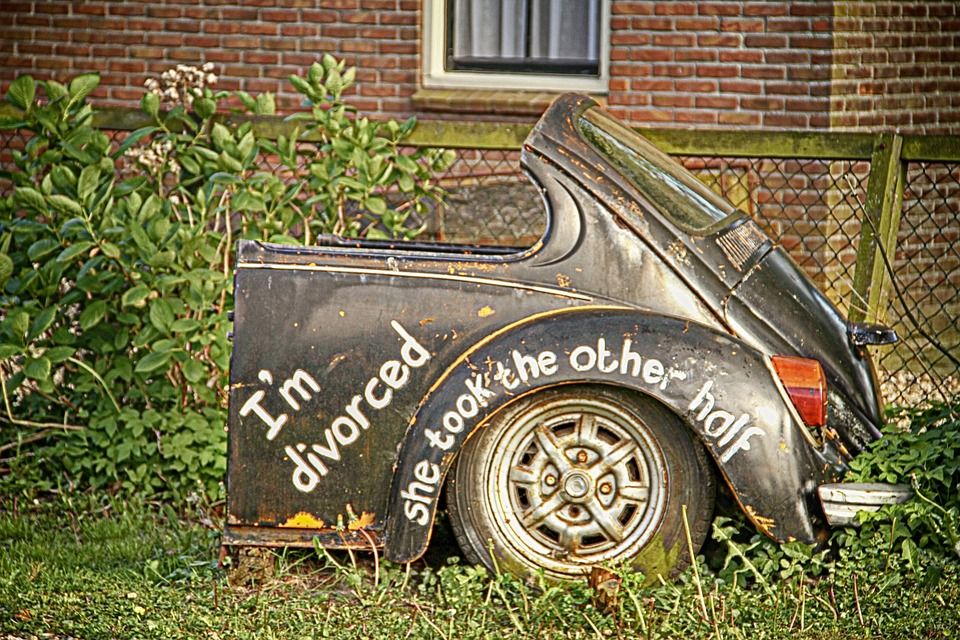

When two people divorce, many questions arise. One of the most common questions is whether one party may claim rights to another party’s inheritance funds acquired during the marriage. What you do with the assets upon receipt may influence whether you will have to part a portion of those assets upon divorce. At Simonetti & Associates in Nassau County, we are determined to answer any questions you have about your divorce process and ensure the best possible outcome with your inherited assets.

Statutory laws protect inheritances in all states. This means that if you receive an inheritance, the law declares that your spouse has no right to it during or after your marriage. However, it is very easy to undo this protection if you come across an obstacle. Your inheritance is your sole and separate property as long as you understand the correct steps when segregating from marital assets.

Commingling

If your inheritance is cash and you deposit it into an account held in joint names with your spouse, you commingled it. Commingling means you mix marital money or property with your spouse. In this case, your spouse will receive and is entitled to a portion of your inheritance.

Non-Monetary Contributions

Your inherited assets may be unprotected if your spouse has made non-monetary contributions to the inheritance. For example, if you inherit property in Nassau County that is in poor condition and your spouse works on the property themselves, they now have “sweat equity” which will be recognized in court.

Transmutation

When married, any income you earn is marital property. If you use your income to repair the property you inherited, you begin to erode its immunity. Each time you pay a laborer or take out an equity loan from marital funds, you are transmuting your property.

If you have acquired inheritance before marriage, the best way to safeguard the assets is to find out how a prenuptial agreement may help you determine what can and cannot be included. If you live in Nassau County and have any questions or concerns in regards to your inheritance and divorce, be sure to call Simonetti & Associates at 516-248-5600.